All Categories

Featured

Table of Contents

In spite of being recognized, all investors still require to perform their due diligence during the procedure of investing. Accredited financiers can access our selection of vetted investment possibilities.

With over $1.1 billion in safeties marketed, the management group at 1031 Crowdfunding has experience with a variety of financial investment structures. To access our complete offerings, register for a financier account.

Accredited's workplace society has frequently been We think in leaning in to sustain improving the lives of our coworkers in the same means we ask each various other to lean in to passionately support enhancing the lives of our clients and community. We give by using ways for our group to rest and re-energize.

Secure Exclusive Investment Opportunities For Accredited Investors Near Me

We additionally provide to Our beautifully appointed structure includes a fitness area, Rest & Relaxation spaces, and innovation developed to support versatile work areas. Our ideal ideas originate from teaming up with each various other, whether in the office or functioning from another location. Our positive financial investments in innovation have allowed us to produce a permitting team to contribute any place they are.

If you have an interest and feel you would be a great fit, we would certainly like to link. Please ask at.

Tailored Accredited Crowdfunding – Denver

Recognized financiers (in some cases called qualified financiers) have access to financial investments that aren't offered to the basic public. These financial investments could be hedge funds, tough money finances, exchangeable investments, or any kind of other security that isn't registered with the financial authorities. In this article, we're going to concentrate especially on realty financial investment choices for recognized capitalists.

This is every little thing you need to recognize about realty investing for approved capitalists (real estate investing for accredited investors). While any person can purchase well-regulated protections like stocks, bonds, treasury notes, common funds, etc, the SEC is concerned concerning typical financiers getting involved in financial investments beyond their ways or understanding. Rather than enabling anyone to spend in anything, the SEC created an approved investor standard.

It's important to bear in mind that SEC policies for recognized investors are developed to protect capitalists. Without oversight from monetary regulatory authorities, the SEC simply can not examine the threat and reward of these financial investments, so they can not offer information to enlighten the ordinary capitalist.

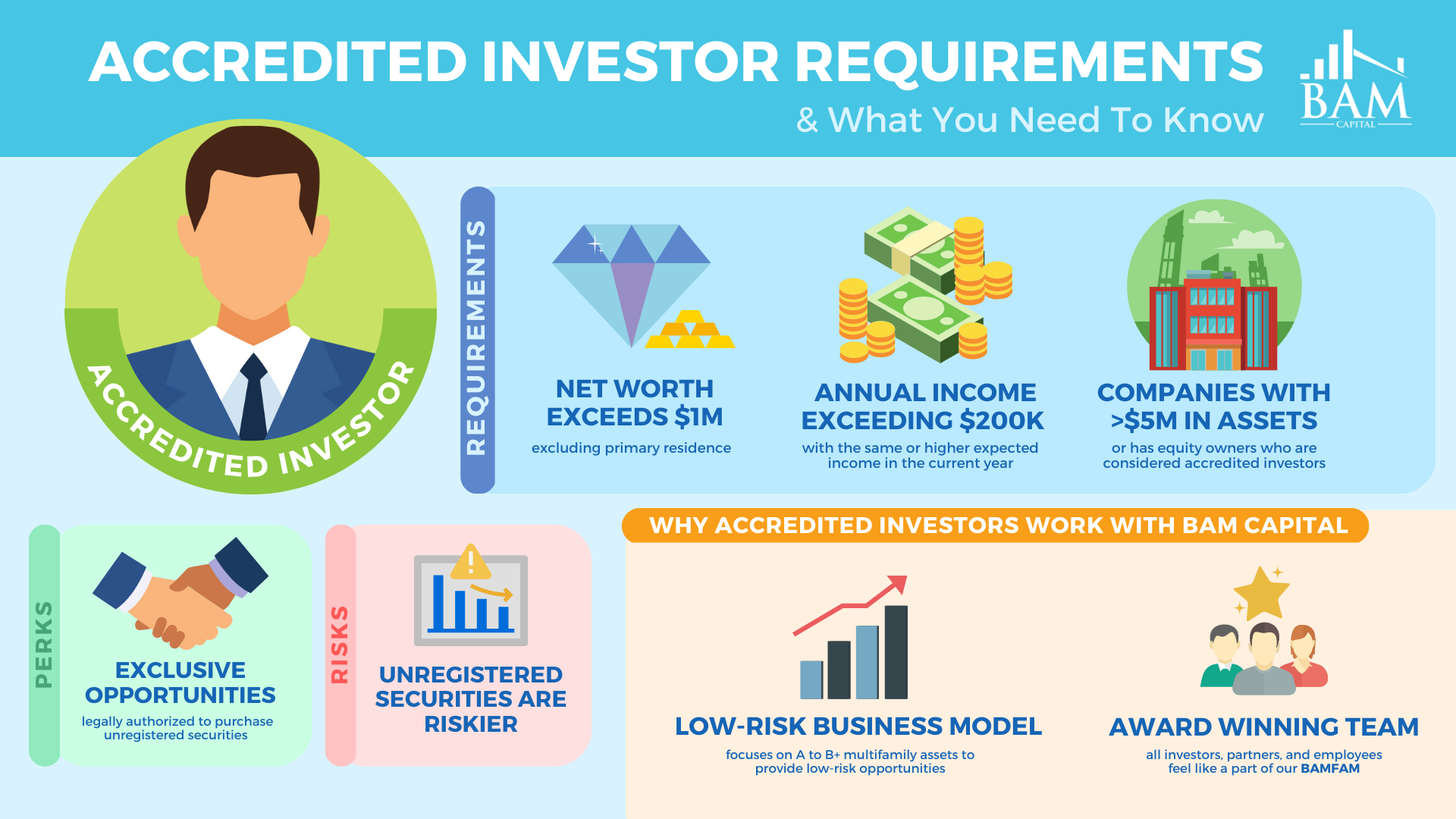

The concept is that investors who gain adequate revenue or have sufficient wealth are able to soak up the threat better than capitalists with lower revenue or less wealth. As a recognized financier, you are anticipated to complete your very own due persistance prior to adding any kind of property to your financial investment portfolio. As long as you meet one of the adhering to 4 needs, you certify as an accredited financier: You have actually gained $200,000 or more in gross income as an individual, each year, for the past two years.

Dependable 506c Investment Near Me

You and your spouse have had a combined gross earnings of $300,000 or even more, each year, for the past 2 years. And you anticipate this degree of revenue to proceed. You have a web worth of $1 million or even more, excluding the value of your key residence. This indicates that all your possessions minus all your financial debts (excluding the home you stay in) complete over $1 million.

Or all equity owners in the company qualify as accredited financiers. Being an approved financier opens up doors to investment possibilities that you can't access otherwise.

Dependable Investment Opportunities For Accredited Investors Near Me – Denver Colorado

Coming to be a certified financier is merely a matter of verifying that you satisfy the SEC's needs. To validate your income, you can offer paperwork like: Tax return for the past 2 years, Pay stubs for the past 2 years, or W2s for the previous two years. To validate your total assets, you can offer your account statements for all your properties and obligations, consisting of: Cost savings and checking accounts, Financial investment accounts, Impressive financings, And realty holdings.

You can have your lawyer or certified public accountant draft a verification letter, verifying that they have examined your financials which you meet the requirements for a recognized financier. But it might be more affordable to use a solution specifically developed to verify recognized capitalist standings, such as EarlyIQ or .

Reliable Alternative Investments For Accredited Investors Near Me

, your accredited financier application will be processed via VerifyInvestor.com at no cost to you. The terms angel financiers, sophisticated investors, and certified investors are frequently utilized reciprocally, however there are subtle differences.

Normally, any person that is accredited is presumed to be an innovative financier. The income/net worth demands continue to be the exact same for foreign capitalists.

Here are the finest financial investment opportunities for recognized financiers in real estate.

Some crowdfunded realty investments don't need accreditation, yet the projects with the biggest possible rewards are commonly scheduled for accredited financiers. The difference in between projects that approve non-accredited capitalists and those that only accept accredited financiers typically comes down to the minimal financial investment amount. The SEC presently limits non-accredited financiers, that earn less than $107,000 per year) to $2,200 (or 5% of your yearly earnings or net well worth, whichever is much less, if that amount is more than $2,200) of financial investment capital each year.

Latest Posts

Investing In Property Tax Liens

Buying Delinquent Tax Property

Tax Liens Investment